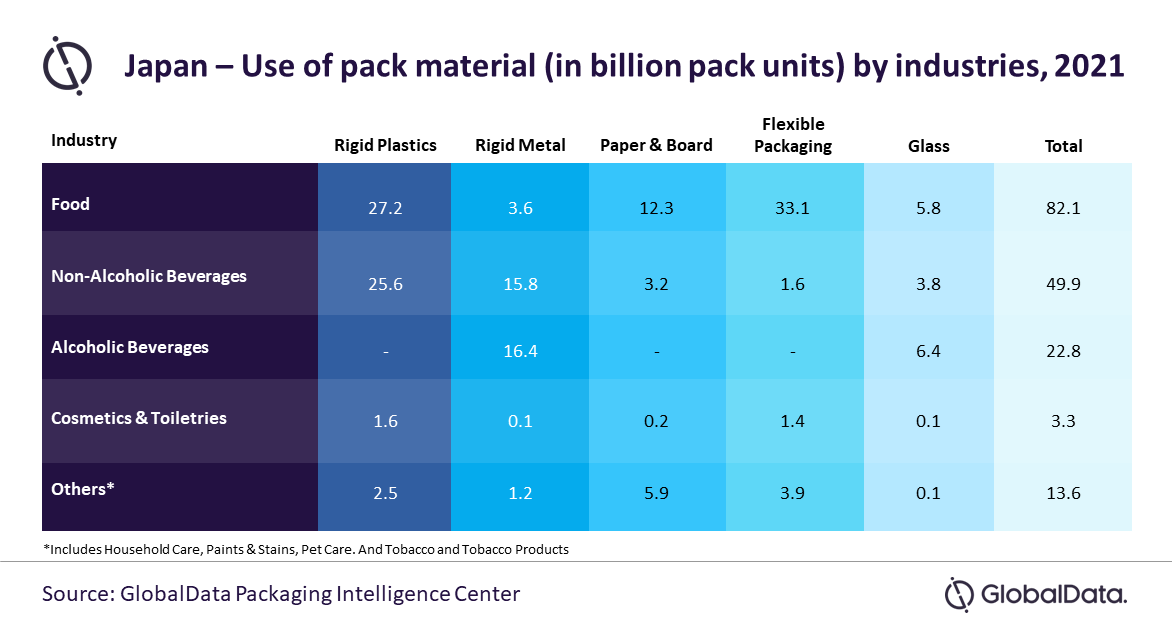

GlobalData’s latest report, “Japan Packaging Market Size, Analysing Key Pack Material (Pack Type, Closure Material and Type, Primary Outer Material and Type), Innovations and Forecast, 2021-2026,” reveals that flexible packaging and rigid metal accounted for shares of 23.3% and 21.5%, respectively, in 2021.

Srimoyee Nath, Consumer Analyst at GlobalData, comments: “Apart from its easy and convenient storage, low cost and light weight features contribute to rigid plastics’ significant usage in packaging. Concurrently, rigid metal is anticipated to record the fastest CAGR of 2.6% during 2021-26. Increasing awareness regarding plastic waste and its harmful effects on the environment is likely to increase the use of rigid metal during the forecast period.

“Growing environmental awareness is leading consumers to switch to sustainable packaging formats, such as metal and glass packaging. At the same time, the increasing need for convenience-driven features such as light weight, portability, and small sizes is boosting the demand for rigid plastics and flexible packaging.”

According to the report, the food industry in Japan is the primary user of packaging materials accounting for a 47.8% share in 2021. Within the food industry, flexible packaging was the most widely used pack material, followed by rigid plastics.

Nath explains: “The demand for flexible packaging in food products is mostly attributed to its high consumption in bakery & cereals, dried food, and savory snacks, wherein consumers tend to look for products that offer convenience features such as zip locks, resealable closures, and light weight. The non-alcoholic beverages industry was the second-largest user of packaging materials in the country.”

During the forecast period, rigid metal and rigid plastics are expected to lead the growth, with a significant usage in food, non-alcoholic, and alcoholic beverages industries. Their user-friendly features (convenience) and attractive shapes and labels will appeal to comfort-seeking and experimental consumers.

Nath concludes: “Recyclability and reusability characteristics along with rising preference for on-the-go consumption among consumers are set to propel the demand for rigid metal and rigid plastics packages. Packaging will become more consumer centric as consumers will increasingly pay greater attention to features such as convenience. To keep up with the pace, manufacturers need to constantly innovate and stay competitive.”

www.globaldsta.com